Unlocking the Immutable Code: How Bitcoin’s Fixed Supply Revolutionizes Monetary Integrity

Discover how Bitcoin’s mathematically enforced scarcity stands as a bulwark against political manipulation and systemic corruption, offering a paradigm shift in financial governance.

Bitcoin’s fixed supply isn’t just economics, it’s a safeguard against the political temptation to print value out of existence. Unlike fiat currency, it can’t be manipulated to buy votes, fund endless wars, or bail out failing institutions. It’s money governed by math, not by politicians, and that makes it one of the few financial systems in the world truly resistant to corruption.

50+ Sources

- 1.Highlights of Bitcoin’s Anti-Corruption Design

- 2.The Unwavering Cap: Bitcoin’s 21 Million Coin Limit

- 3.The Battle Against Inflation: Why Fixed Supply Matters

- 4.Decentralization: The Ultimate Anti-Corruption Mechanism

- 5.Contrasting Bitcoin with Fiat Currency Systems

- 6.The Philosophical Underpinnings of Resistance Money

- 7.Key Differences: Bitcoin vs. Fiat Currency

- 8.Frequently Asked Questions

- 9.Conclusion

- 10.Recommended Further Exploration

- 11.Referenced Search Results

Highlights of Bitcoin’s Anti-Corruption Design

- Immutable Supply Cap: Bitcoin’s maximum supply of 21 million coins is hard-coded into its protocol, making it unchangeable without an unprecedented global consensus, thereby eliminating arbitrary supply expansion.

- Predictable Halving Schedule: The rate of new Bitcoin issuance is systematically reduced approximately every four years through halvings, ensuring a transparent and predictable deflationary trajectory.

- Resistance to Political Influence: Unlike fiat currencies, Bitcoin’s monetary policy is governed by mathematical rules and decentralized consensus, making it immune to political pressures for inflation, war funding, or bailouts.

Bitcoin’s fundamental design principle, its fixed supply of 21 million coins, is not merely an economic feature but a cornerstone of its integrity against political manipulation. This inherent scarcity, enforced by its protocol, positions Bitcoin as a unique financial system resilient to the inflationary practices and arbitrary decisions often associated with traditional fiat currencies. The core idea is to create a form of money that operates on verifiable mathematical principles rather than the discretionary policies of central authorities.

The Unwavering Cap: Bitcoin’s 21 Million Coin Limit

A Deep Dive into the Protocol-Enforced Scarcity

The 21 million coin limit is a defining characteristic of Bitcoin, directly embedded within its source code. This hard cap means that once 21 million bitcoins have been mined, no more will ever be created. This predetermined maximum supply stands in stark contrast to fiat currencies, where central banks can theoretically print an unlimited amount of money, often leading to inflation and a decrease in purchasing power. This fixed supply is a critical element in Bitcoin’s value proposition as a “digital gold,” offering a predictable store of value that is not subject to inflationary pressures from supply expansion.

How the Fixed Supply is Enforced

Bitcoin’s fixed supply is maintained through a combination of its algorithmic protocol and the decentralized consensus mechanism. Miners, who validate transactions and add new blocks to the blockchain, are rewarded with newly minted bitcoins. However, this reward is halved approximately every four years, a process known as “halving.” This scheduled reduction in new coin issuance ensures a steadily decreasing rate of supply until all 21 million coins are mined, which is projected to occur around the year 2140. This entire process is transparent and verifiable by anyone participating in the network, fostering a financial system built on immutable rules rather than political discretion.

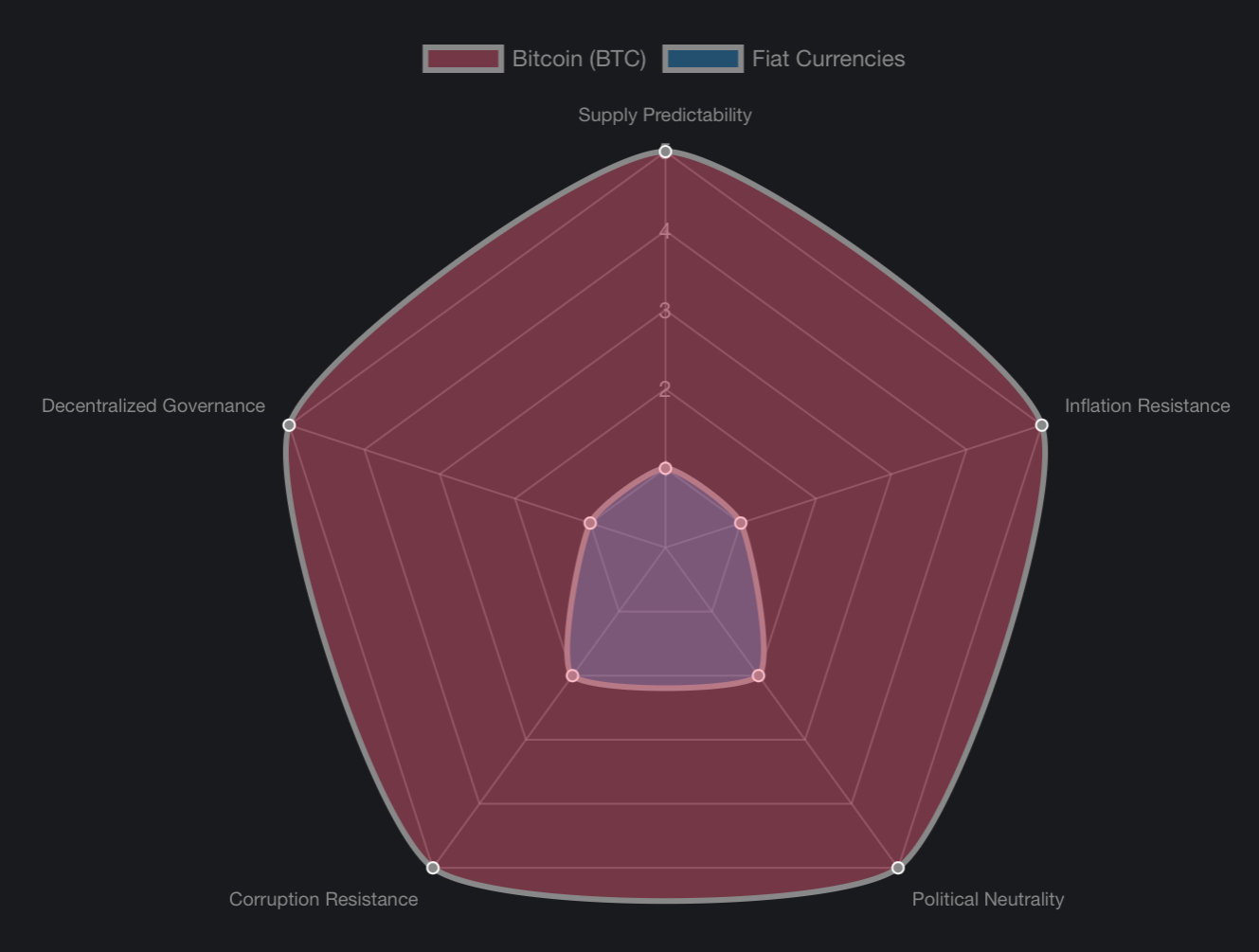

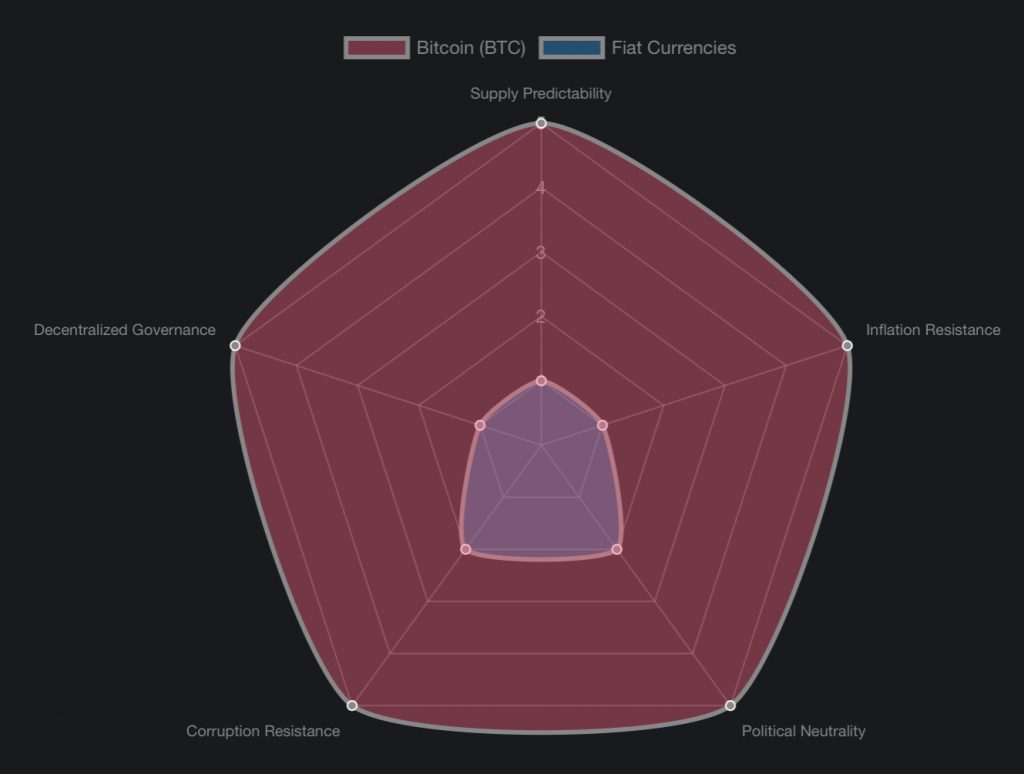

This radar chart illustrates a comparative analysis of Bitcoin’s and Fiat Currencies’ characteristics regarding supply, inflation, and political neutrality. Bitcoin consistently scores higher in areas related to predictability and resistance to manipulation, reflecting its design as a mathematically governed financial system.

The Battle Against Inflation: Why Fixed Supply Matters

Safeguarding Value in a World of Monetary Expansion

One of the most significant implications of Bitcoin’s fixed supply is its inherent resistance to inflation. In traditional economic systems, governments and central banks can expand the money supply through various means, such as quantitative easing or direct printing of currency. This expansion often leads to inflation, where the purchasing power of money diminishes over time. Such policies can be enacted for a variety of reasons, including funding government expenditures, stimulating economic growth, or managing national debt. However, these actions can also devalue the savings and wealth of citizens.

Bitcoin’s design completely sidesteps this issue. Because its supply is capped and its issuance schedule is transparent and immutable, it cannot be arbitrarily inflated. This makes Bitcoin a potentially powerful hedge against inflation, preserving its value over the long term. This characteristic is particularly attractive in environments where trust in traditional financial institutions or government monetary policies is low.

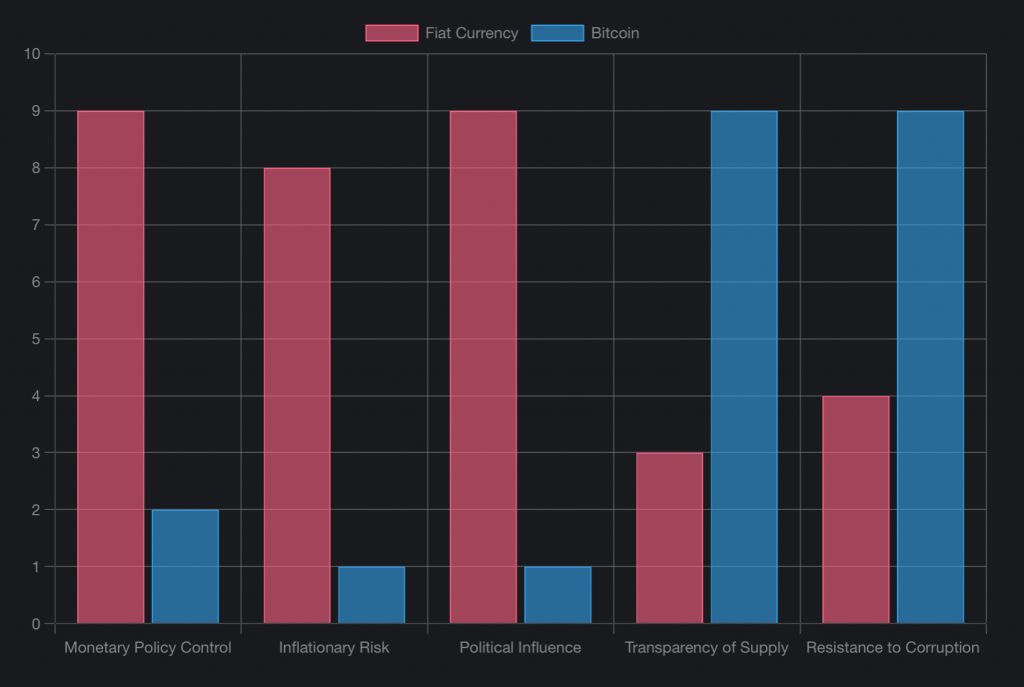

This bar chart compares the levels of monetary policy control, inflationary risk, political influence, transparency, and corruption resistance between fiat currency and Bitcoin. The chart clearly indicates Bitcoin’s superior performance in areas of transparency and resistance to manipulation.

Decentralization: The Ultimate Anti-Corruption Mechanism

Beyond Economics: A Stand Against Political Temptation

Beyond its economic implications, Bitcoin’s fixed supply and decentralized nature serve as a powerful safeguard against political corruption. Traditional financial systems, being centralized, are vulnerable to political pressures and the temptation to manipulate the money supply for various ends. These can include funding military conflicts, bailing out failing financial institutions, or even “buying votes” through various government programs that require increased spending and, consequently, an expanded money supply.

Bitcoin’s design removes this central point of control. No single entity, government, or individual can unilaterally decide to print more bitcoins or alter its monetary policy. The network’s consensus mechanism requires widespread agreement among participants to make any changes, making it incredibly difficult to introduce alterations that would benefit a select few at the expense of the many. This mathematical governance ensures that Bitcoin’s rules are applied uniformly and transparently to all, fostering a truly corruption-resistant financial environment.

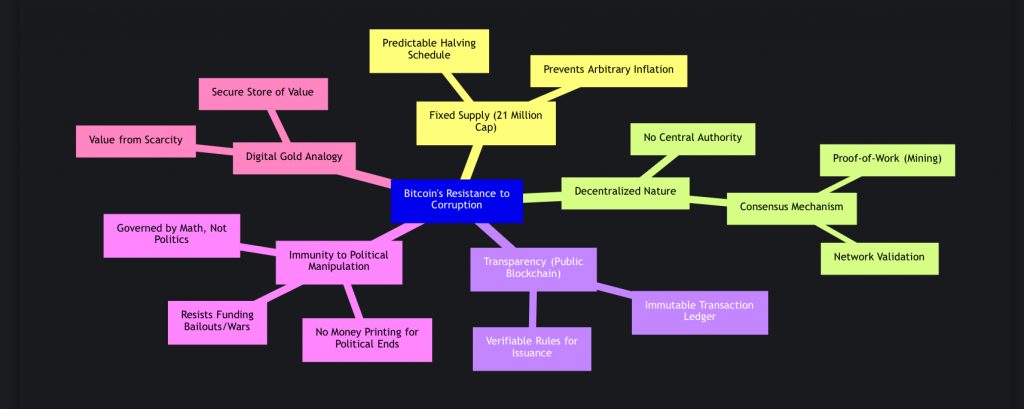

mindmap

root[“Bitcoin’s Resistance to Corruption”]

Fixed_Supply[“Fixed Supply (21 Million Cap)”]

Prevents_Inflation[“Prevents Arbitrary Inflation”]

Predictable_Issuance[“Predictable Halving Schedule”]

Decentralization[“Decentralized Nature”]

No_Central_Authority[“No Central Authority”]

Consensus_Mechanism[“Consensus Mechanism”]

Proof_of_Work[“Proof-of-Work (Mining)”]

Network_Validation[“Network Validation”]

Transparency[“Transparency (Public Blockchain)”]

Immutable_Ledger[“Immutable Transaction Ledger”]

Verifiable_Rules[“Verifiable Rules for Issuance”]

Immunity_to_Political_Manipulation[“Immunity to Political Manipulation”]

No_Money_Printing[“No Money Printing for Political Ends”]

Resists_Bailouts[“Resists Funding Bailouts/Wars”]

Mathematical_Governance[“Governed by Math, Not Politics”]

Digital_Gold_Analogy[“Digital Gold Analogy”]

Store_of_Value[“Secure Store of Value”]

Scarcity_Value[“Value from Scarcity”]

This mindmap illustrates how Bitcoin’s inherent characteristics, such as its fixed supply, decentralization, and transparency, collectively contribute to its robust resistance against corruption and political manipulation.

Contrasting Bitcoin with Fiat Currency Systems

A Tale of Two Monetary Policies

The distinction between Bitcoin and fiat currency systems is stark, particularly concerning their underlying monetary policies and vulnerability to corruption. Fiat currencies, by definition, are legal tender whose value is derived from government decree, not from an intrinsic commodity. Their supply is controlled by central banks, which can adjust it based on economic conditions or political objectives.

This discretionary control, while offering flexibility, also opens the door to potential abuses. Governments might be tempted to increase the money supply to finance deficits, reduce debt burdens, or stimulate the economy, often leading to devaluation. This can erode public trust and disproportionately affect those with fixed incomes or limited access to financial assets.

Bitcoin, in contrast, operates under a set of predefined, unchangeable rules. Its monetary policy is algorithmic and transparent, removing the human element of discretion. This fundamental difference is why many view Bitcoin as a more reliable and incorruptible form of money.

A physical representation of a Bitcoin, symbolizing its digital scarcity and value.

The Philosophical Underpinnings of Resistance Money

Bitcoin as a Tool for Financial Freedom and Integrity

The concept of “resistance money” aligns perfectly with Bitcoin’s design. It represents a form of currency that resists external pressures, whether from governments, corporations, or other powerful entities. This resistance is not just theoretical; it’s built into the very code and economic incentives of the network.

The immutability of Bitcoin’s supply and its decentralized nature mean that it cannot be easily weaponized or controlled to serve political agendas. This offers a powerful alternative for individuals seeking to protect their wealth from inflationary government policies, capital controls, or even outright confiscation. In this sense, Bitcoin embodies a philosophical stance against centralized control and arbitrary power over money.

The video below offers further insight into the philosophical arguments supporting Bitcoin’s role as “resistance money” and its implications for financial freedom.

This YouTube video, “Bitcoin is valuable because it’s censorship resistant with…”, delves into the philosophical foundations of Bitcoin, emphasizing its censorship resistance as a core element of its value proposition and its role as a form of resistance money.

Key Differences: Bitcoin vs. Fiat Currency

A Comparative Overview

To further illustrate the fundamental differences, here’s a table summarizing key aspects of Bitcoin and traditional fiat currencies:

| Feature | Bitcoin (BTC) | Fiat Currency (e.g., USD, EUR) |

|---|---|---|

| Supply Limit | Fixed at 21 million coins | Unlimited, can be increased by central banks |

| Issuance Mechanism | Algorithmic, predictable halvings | Discretionary, based on monetary policy decisions |

| Control Authority | Decentralized network consensus | Central banks and governments |

| Inflation Risk | Designed to be deflationary due to fixed supply | Vulnerable to inflation due to supply expansion |

| Transparency | Public, verifiable blockchain ledger | Often opaque, decisions made by committees |

| Resistance to Corruption | High, due to mathematical rules and decentralization | Vulnerable to political influence and corruption |

| Portability/Accessibility | Global, permissionless, digital | Subject to national borders, banking hours, and regulations |

| Censorship Resistance | High, transactions difficult to block or reverse | Low, transactions can be censored or frozen by authorities |

Frequently Asked Questions

Why is Bitcoin’s supply limited to 21 million?

Bitcoin’s supply is limited to 21 million coins by its underlying protocol to create scarcity and prevent inflation, mimicking the properties of precious metals like gold. This cap is hard-coded and cannot be easily changed.

How does Bitcoin’s fixed supply prevent corruption?

By having a fixed and predictable supply, Bitcoin removes the ability for any central authority (like a government or central bank) to manipulate the currency by printing more money. This eliminates the temptation to fund wars, bailouts, or political agendas through inflationary policies, making it resistant to certain forms of corruption.

What is a Bitcoin halving?

A Bitcoin halving is an event where the reward for mining new blocks is cut in half. This occurs approximately every four years, or every 210,000 blocks, and is a key mechanism for controlling the supply of new bitcoins and ensuring the 21 million coin limit is reached predictably.

Can Bitcoin’s supply limit be changed?

The 21 million coin limit is part of Bitcoin’s core protocol. While technically possible to change, it would require a near-unanimous consensus from the global Bitcoin network, including miners, nodes, and developers. Such a change is highly unlikely given the network’s decentralized nature and the fundamental principle of scarcity that underpins Bitcoin’s value.

Conclusion

Bitcoin’s fixed supply is far more than a simple economic parameter; it is a profound declaration of monetary policy designed to counter the historical vulnerabilities of centralized financial systems. By embedding a hard cap of 21 million coins and a predictable halving schedule into its protocol, Bitcoin fundamentally redefines trust in money. It shifts reliance from fallible human institutions to immutable mathematical rules, creating a system inherently resistant to the inflationary temptations, political manipulations, and corrupt practices that often plague fiat currencies. This mathematical governance ensures transparency, predictability, and a level playing field, offering a compelling vision for a financial future built on integrity and sound principles.

Recommended Further Exploration

- [How does the Bitcoin halving schedule impact its value proposition?](/?query=How does the Bitcoin halving schedule impact its value proposition?)

- [What are the historical examples of fiat currency inflation and their consequences?](/?query=What are the historical examples of fiat currency inflation and their consequences?)

- [Exploring the concept of ‘digital gold’ and its relevance to Bitcoin’s scarcity.](/?query=Exploring the concept of ‘digital gold’ and its relevance to Bitcoin’s scarcity.)

- [The role of decentralization in preventing corruption in financial systems.](/?query=The role of decentralization in preventing corruption in financial systems.)

Referenced Search Results

komodoplatform.com

Bitcoin vs. Fiat Currencies: Understanding The Differences – Komodo Platform

101blockchains.com

Fiat Currency vs Cryptocurrency: Key Differences – 101 Blockchains

bitpanda.com

The difference between a cryptocurrency and fiat money — Bitpanda Academy

kraken.com

cointelegraph.com

CoinTelegraph: Can Bitcoin’s hard cap of 21 million be changed?

investopedia.com

Investopedia: Why Governments Are Wary of Bitcoin

linkedin.com

IMF’s Dirty Secrets: Why Bitcoin Doesn’t Need Corruption – LinkedIn

blockworks.co

Is Crypto Fueling Corruption or Helping Citizens Flee It? – Blockworks

reddit.com

Can Blockchain Fight Government Corruption? – Reddit r/CryptoCurrency

skalex.io

The Deflationary Economics of the Bitcoin Money Supply

casten.house.gov

Casten, Smith Demand DOJ Investigation Into Trump Crypto Dinner

theguardian.com

‘Roadmap for corruption’: Trump dive into cryptocurrency raises …

forbes.com

Bitcoin Supply Is Limited By More Than Just The Halvings

ssb.texas.gov

Fiat v. Virtual Currency | Texas State Securities Board

whitehouse.gov

hedera.com

Fiat vs Crypto: A Comprehensive Comparison | Hedera

trmlabs.com

The Crypto Election: Crypto, Disinformation, and Presidential Politics

fool.com

Fiat vs. Crypto: How Crypto Will Affect Fiat Money | The Motley Fool

pubsonline.informs.org

Regulation, Corruption, and Decentralized Autonomous Organizations

reddit.com

r/CryptoTechnology on Reddit: Do you think bitcoin with a fixed supply is a good or a bad thing?

politico.com

The one Trump issue that is dividing Democrats – POLITICO

forbes.com

Bitcoin’s ‘Best Asset’ (Fixed Supply) Shows Why It Will Never Be Money

ey.com

The Bitcoin Halving explained | EY – Switzerland

pbs.org

Once a crypto skeptic, Trump is now a big fan of the industry – PBS

en.bitcoin.it

Controlled supply – Bitcoin Wiki

investopedia.com

What Happens to Bitcoin After All 21 Million Are Mined?

blockchain-council.org

How Many Bitcoins are there and How many are Left …

brookings.edu

Protecting the American public from crypto risks and harms | Brookings

forbes.com

Bitcoin’s Fixed Supply Remains Its Biggest Demerit

dig.watch

Bitcoin’s political puppeteers: From code to clout

belfercenter.org

Crypto-Oligarchy And Its Impact on U.S. Electoral Outcomes

linkedin.com

How Many Bitcoins Are Left? All You Need to Know

edgemedianetwork.com

How Does Bitcoin’s Fixed Maximum Supply Work? | EDGE United States

sciencedirect.com

Blockchain-based governance models supporting corruption …

forbes.com

Resistance Builds Against The Warren “Anti-Crypto” Agenda – Forbes

sciencedirect.com

Bitcoin vs. fiat currencies: Insights from extreme dependence and …

finance.yahoo.com

Warren Warns Crypto Regulation ‘Supercharges President Trump’s …

ainvest.com

Senator Warren Pushes for Independent Crypto Oversight to Prevent …

ccn.com

What Happens to Bitcoin After All 21 Million Are Mined?

reddit.com

Bitcoin supply is fixed meaning it can never replace an actual currency. : r/Buttcoin

coincentral.com

Crypto Week Begins in Congress Amid Sharp Democratic Resistance

reddit.com

r/Bitcoin on Reddit: Why is bitcoin always compared to fiat?

river.com

Can Bitcoin’s Hard Cap of 21 Million Be Changed? | River Learn – Bitcoin Basics

statista.com

Low supply cryptocurrency 2025 | Statista

nytimes.com

How Crypto Lobbying Won Over Trump – The New York Times

bitcoins.net

Limits of Supply | 21 million Bitcoins

moderntreasury.com

What is the Difference Between Fiat and Cryptocurrency?

decrypt.co

Why is Bitcoin’s supply limit set to 21 million? – Decrypt

ourfinancialsecurity.org

Blog: A Crypto Coup? How Billionaires Are Threatening Democracy …

gemini.com

Fiat vs. Crypto & Digital Currencies: Full Guide | Gemini

Last updated August 15, 2025